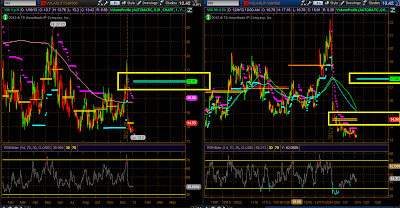

NQ double H&S topping patterns. AAPL's recent struggles have been curtailing NQ, 1yr (left) pretty firm H&S developing and confluence with 1yr VAH. 90d, hourly chart (right) mini H&S. Will be eyeing uturn shorts off 90d VAH @ 2750/2740 levels.

VIX may not have completely hit rock bottom yet, but lack of volume on ES and VIX just drifting away any negative news could flush markets and spike VIX. Looking at long calls on the short-dated side, or longer-term call spreads in June expiry. Target #1 14.56, Jan reversion; target #2 17.66 90d reversion, max target 20.41 1yr reversion.

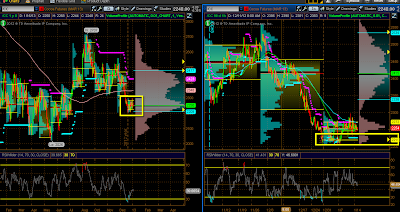

CL major wedge developing on daily chart. Breakout higher seems imminent (left), but 90d hourly chart showing major consolidations. 101 upside breakout target (VAH) and pullback entry 91.00.

DX small wedge on daily, looking for move away from POC to test edges (left) and hourly chart buy zone 79.40 - 79.60 level (right)

NG Missed breakout Monday (right chart, yellow box) - pullback level to 3.3550 swing low test perfect spot to consider long. Daily chart breakout of bull flat (left).

SB H&S formation breaking down; possible VAL support on 1yr (left) chart and swing low test (lower yellow box on right chart) of hourly. move to 90d POC 19.30 seems very strong, also 19.49 daily POC.

CC Heavy consolidation @ 1yr POC/VAL. Jan VAL 2219 & 1yr VAL 2209 should be spot for uturn long

BIDU channel trade. Could see a pullback to lower levels @ daily POC. Recent action attracted to 90d POC, but cannot make newer highs (right chart).

No comments:

Post a Comment