Entry, buy @ 884.00

Stop @ 876.00. Risk +$400/lot.

Target @ 900.00. Potential gain = $800/lot.

Gold update:

Stop adjusted higher.

Swissie (6S futures) update:

Stop adjusted to 1.08. Some RSI divergence at new highs a concerning spot for a potential reversal.

Natty update:

Also some RSI divergence developing. Stop still at breakeven on remaining.

Wheat update:

Still awaiting a fill, stop @ breakeven.

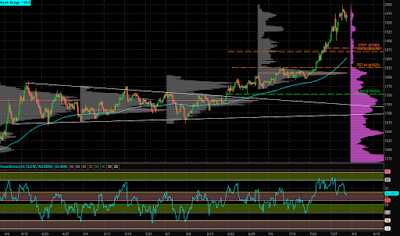

Possible set up in copper developing.

Large rally:

Triangle balancing zone, breakout up or down could get some nice directional action: