Late to post. Copper short finally fired off at 5:05 a.m.

Had marked the entry 2.869:

Entry short 2.869

Risk 2.947. $1950/lot

Target 2.724. $3625/lot

JBTFD

Friday, August 7, 2020

Thursday, August 6, 2020

Position Updates.

Sadly, the beans trade was profitable, but management towards target missed by only ONE tick!!! That is trading, folks.

Net result: Breakeven.

Wheat, also a breakeven result, but did show a possible short entry. Again, failure to act on that against an existing long position was a mistake. Several methods could have been used: short a longer dated future contract; short a call spread (or buy a put spread); or buy puts.

Net result: Breakeven. No options, no other futures trade short.

Nat Gas continues to chug ahead. BUT...

Some developing RSI divergence could be pointing to a reversal. Stop raised to 2.05. A possible hedge here is to take a bearish options play, either buying puts or a bearish options spread (selling call spread or buying a put spread - for defined risk/reward.) Nothing jumped out upon analysis yesterday afternoon, so will await EIA data today to determine if a hedge is a better idea.

Swissie (6S futures), continues to remain strong.

BUT, like many assets that have rallied strong recently, there is a developing RSI divergence here. There are no options on these futures, and dated futures contracts are too thin for a hedge. Stop raised.

Gold:

Also, remaining strong. Firmly above $2000 now. Stop has been adjusted, while some mild RSI divergence is developing, over the next trading session, I will determine if it's time to adjust stop even higher.

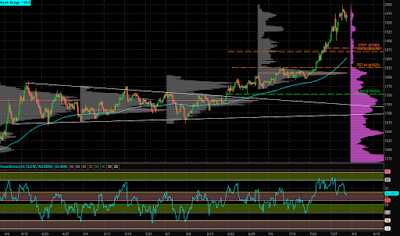

Copper:

There was a triangle pattern break. I did not enter, was fortunate to have been distracted at the time. A second attempt may be in the works, but the technical pattern growing somewhat muddled. There could be a decent 'risk-off' trade across a variety of asset classes as the bullish bias has been pressing consistently for weeks, even months now and there could be an opportunity for them to take a breather. Wait and watch mode on this one.

Net result: Breakeven.

Wheat, also a breakeven result, but did show a possible short entry. Again, failure to act on that against an existing long position was a mistake. Several methods could have been used: short a longer dated future contract; short a call spread (or buy a put spread); or buy puts.

Net result: Breakeven. No options, no other futures trade short.

Nat Gas continues to chug ahead. BUT...

Some developing RSI divergence could be pointing to a reversal. Stop raised to 2.05. A possible hedge here is to take a bearish options play, either buying puts or a bearish options spread (selling call spread or buying a put spread - for defined risk/reward.) Nothing jumped out upon analysis yesterday afternoon, so will await EIA data today to determine if a hedge is a better idea.

Swissie (6S futures), continues to remain strong.

BUT, like many assets that have rallied strong recently, there is a developing RSI divergence here. There are no options on these futures, and dated futures contracts are too thin for a hedge. Stop raised.

Gold:

Also, remaining strong. Firmly above $2000 now. Stop has been adjusted, while some mild RSI divergence is developing, over the next trading session, I will determine if it's time to adjust stop even higher.

Copper:

There was a triangle pattern break. I did not enter, was fortunate to have been distracted at the time. A second attempt may be in the works, but the technical pattern growing somewhat muddled. There could be a decent 'risk-off' trade across a variety of asset classes as the bullish bias has been pressing consistently for weeks, even months now and there could be an opportunity for them to take a breather. Wait and watch mode on this one.

Thursday, July 30, 2020

Beans Long. Updates.

November Soybeans Long.

Entry, buy @ 884.00

Stop @ 876.00. Risk +$400/lot.

Target @ 900.00. Potential gain = $800/lot.

Gold update:

Stop adjusted higher.

Swissie (6S futures) update:

Entry, buy @ 884.00

Stop @ 876.00. Risk +$400/lot.

Target @ 900.00. Potential gain = $800/lot.

Gold update:

Stop adjusted higher.

Swissie (6S futures) update:

Stop adjusted to 1.08. Some RSI divergence at new highs a concerning spot for a potential reversal.

Natty update:

Also some RSI divergence developing. Stop still at breakeven on remaining.

Wheat update:

Still awaiting a fill, stop @ breakeven.

Possible set up in copper developing.

Large rally:

Triangle balancing zone, breakout up or down could get some nice directional action:

Friday, July 24, 2020

Thursday, July 23, 2020

Natty Long (plus other updates)

Have not posted here in a long time. Swing trade set-up for Sep. Natty.

LONG $1.70.

STOP $1.63 = risk per lot $700.

TGT #1 $1.84 = $1400.

(If using multiples, TGT #2 $1.91 = $2100.)

I marked $1.92 on image as more optimal exit target at a previous level of resistance. Ideally, if price moves thru $1.91, then trail to $1.91 awaiting $1.92 target.

Seasonality could assist the technical setup here:

Updates (on positions not shared in any prior blog posts):

Aug Live Cattle - loss.

Swissie Long, trail at b/e.

Wheat, waiting for TGT #1; stops moved to B/E.

Gold, TGT 1 & 2 hit, trailing at B/E, waiting to move stop behind ~$1800.

On the radar;

Euro RSI divergence:

5 year, tight coil for volatility spike up or down.

LONG $1.70.

STOP $1.63 = risk per lot $700.

TGT #1 $1.84 = $1400.

(If using multiples, TGT #2 $1.91 = $2100.)

I marked $1.92 on image as more optimal exit target at a previous level of resistance. Ideally, if price moves thru $1.91, then trail to $1.91 awaiting $1.92 target.

Seasonality could assist the technical setup here:

Updates (on positions not shared in any prior blog posts):

Aug Live Cattle - loss.

Swissie Long, trail at b/e.

Wheat, waiting for TGT #1; stops moved to B/E.

Gold, TGT 1 & 2 hit, trailing at B/E, waiting to move stop behind ~$1800.

On the radar;

Euro RSI divergence:

5 year, tight coil for volatility spike up or down.

Wednesday, January 24, 2018

Swissie Breakout

Here's the break out of range on the Swissie on the reopen last night.

Long 1.0496, first target 1.0598.

2:1 risk reward = $637.50 risk, to profit $1275 per contract.

Long 1.0496, first target 1.0598.

2:1 risk reward = $637.50 risk, to profit $1275 per contract.

Friday, January 19, 2018

Euro Short

Strong trend. Bit of a H&S pattern, then a DT at a lower high. TL broke, would look for 2:1 risk/return short on a pullback to 50% Fib.

Risk $812.50. Reward on tgt 1 only = $812.50. TGT 1 + TGT 2 = $2031.25

Risk $812.50. Reward on tgt 1 only = $812.50. TGT 1 + TGT 2 = $2031.25

Subscribe to:

Posts (Atom)